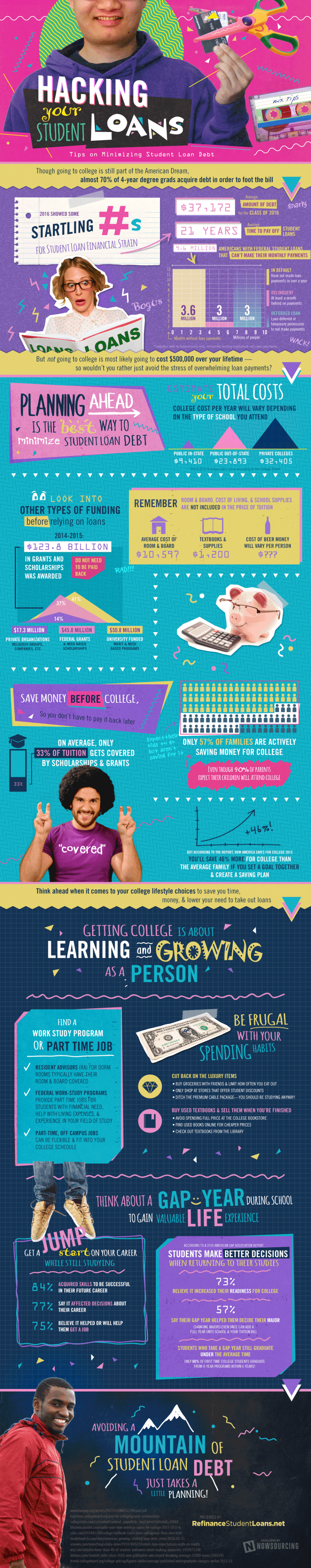

Hacking Student Loans Infographic

The cost of college is out of control, but your student loans don't have to be. The best way to have a chance at a good career is to get a college degree, but it is getting more and more costly to do so. Student loans will follow you for the rest of your life- a cancer on your financial stability. From work study programs to scholarships for having red hair, there are a few things you can do to lessen your burden. After all, you want to be able to focus on your career and not your debt when you graduate! Learn how to minimize your debt load from the Hacking Student Loans Infographic so you can breathe a little easier!

Facts About Student Loans

- 2016 Showed Some Startling Numbers for Student Loan Financial Strain

- Average amount of debt for the class of 2016: $37,172

- Average time to pay off student loans: 21 years

- 9.6 million Americans with federal student loans can’t make their monthly payments

- 3.6 million are in default and have not made a payment in over a year

- 3 million are delinquent and at least a month behind on payments

- 3 million have deferred loans or temporary permission to not make payments

How To Avoid The Stress of Student Loans

- Planning Ahead Is the Best Way to Minimize Student Loan Debt

- Estimate your total costs

- Remember room & board, cost of living, & school supplies are not included in the price of tuition

- Look into other types of funding before relying on loans

- Save money before college, so you don’t have to pay it back later

You can adjust your cookie preferences here.