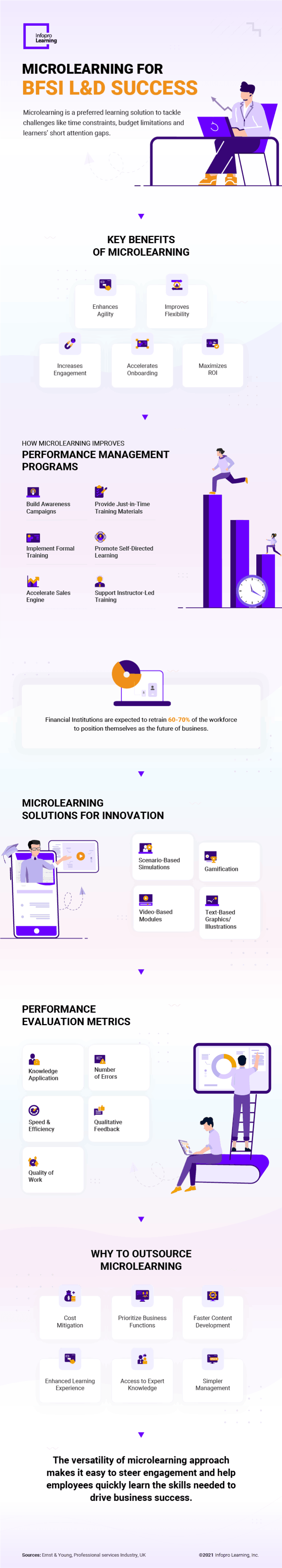

Microlearning for BFSI L&D Success—Infographic

Banking, financial services and insurance organizations are forced to keep the workforce suitably trained and equipped with the right skills to sustain the challenge of rapid technology advancements and economic reforms. To overcome hurdles like time constraints, budget limitations and short attention gaps, microlearning has emerged as a unique learning approach to meet the demands of modern BFSI learners while keeping learners’ engagement intact.

BFSI industry is the most impacted with workforce development challenges as they heavily rely on employees’ skills and diligence. Microlearning, as the go-to-learning solution, offers bite-sized customized courses to address specific skills gaps making the most out of the training budget. It has been recognized as a preferred learning methodology for the banking and finance business as it offers higher knowledge retention to elevate employee performance. With an outsourced strategy, the extensive task of developing microlearning content can be effectively managed and impactfully delivered.

What are the key benefits of microlearning?

- It enhances agility

- It improves flexibility

- It increases engagement

- It accelerates onboarding

- It maximizes ROI

What are some performance evaluation metrics?

- Knowledge Application

- Number of Errors

- Quality of work

- Speed & Efficiency

- Qualitative Feedback

You can adjust your cookie preferences here.