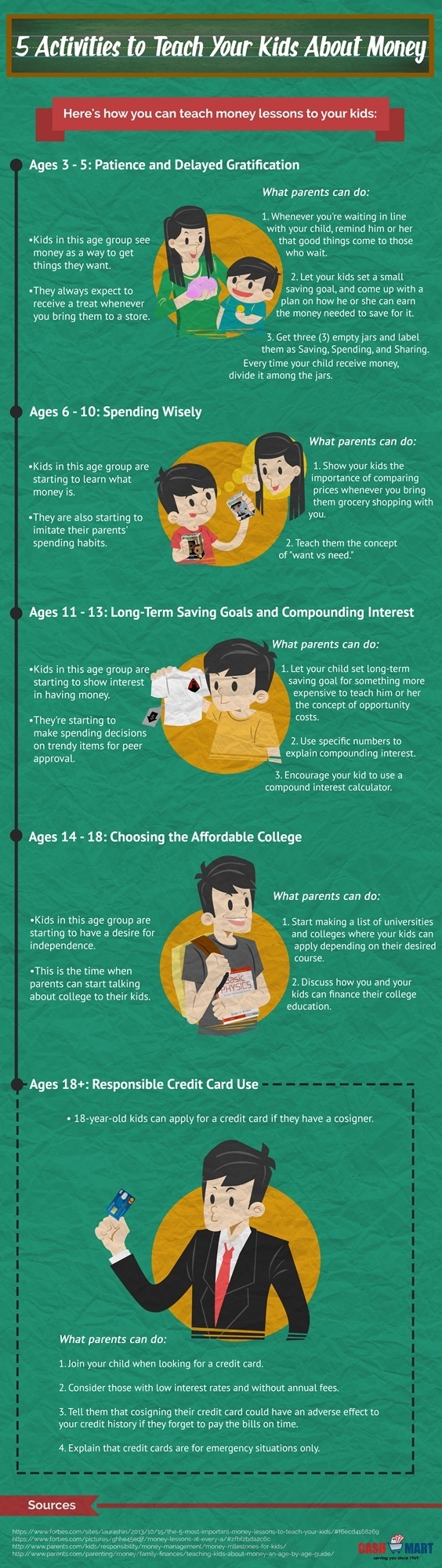

5 Activities to Teach Your Kids about Money Infographic

How can you teach good money habits to your children? According to personal finance author Susan Beacham, “Parents are the most impactful teachers in their kids’ lives.” That said, it the responsibility of moms and dads to teach good money habits to their kids. After all, money management is not taught in school. But how can you do that?

Cash Mart Singapore published an infographic on how you can teach your kids about money. This also includes different money lesson activities that are appropriate for your kids' age. Based on the infographic, each age group views money differently. Thus, you need to come up with different ways to teach your kids about money depending on their age group:

- Ages 3 – 5: Toddlers sees money as a way get what they want. But this may not be the case depending on your family's financial situation. That said, it is best to teach them about patience and delayed gratification around this age.

- Ages 6 – 10: As kids start to learn how to count, they are also starting to learn what money is. However, they may not be able to name bills and coins properly. Regardless, grade school years is the best time to teach them how to spend wisely.

- Ages 11 – 13: Pre-teens is when kids are starting to look for peer approval. At the same time, they are also starting to make buying decisions. As a parent, you can leverage this interest by teaching them to have long-term saving goals and about compounding interest.

- Ages 14 – 18: Kids in this age group are usually finding ways to be independent. According to Get a Financial Life author, Beth Kobliner, this is the best time to talk to your kids about going to college. Just make sure that your kids would not be discouraged because of an expensive tuition fee.

- Ages 18 and older: If you did well as a parent, your child should have good money habits by this time. If that is the case, you can talk to him or her about how to be a responsible credit card user, as well as ways on how he or she can build good credit card score.

While there are many ways to share good money lessons to your children, there are also some things that you need to remember as a parent:

- Teach your kids about the importance of money depending on their stage of development and not their actual age. Allow them to understand how the adult world works by their own terms.

- Every family has different financial situation. That said, do not feel pressured to give allowance to your kids. It is not the only way to provide money to them. There are alternative ways for your kids to have money. and it is up to you as a parent how you can incorporate good money lessons in these situation.

- Money lessons for kids should focus on these five concepts: Earning, spending, sharing, borrowing, and saving money.

- How your kids value money can impact their future.

Our views and opinion about money depends on our family background and childhood experience. The same thing goes with the money lessons we teach our kids.

Whether you have high income or not, it is your role as a parent to teach your kids about money. Money lessons for kids is more than just opening a bank account. It is also about letting them learn how to value money. That way, they will not incur financial burden in the future.

You can adjust your cookie preferences here.