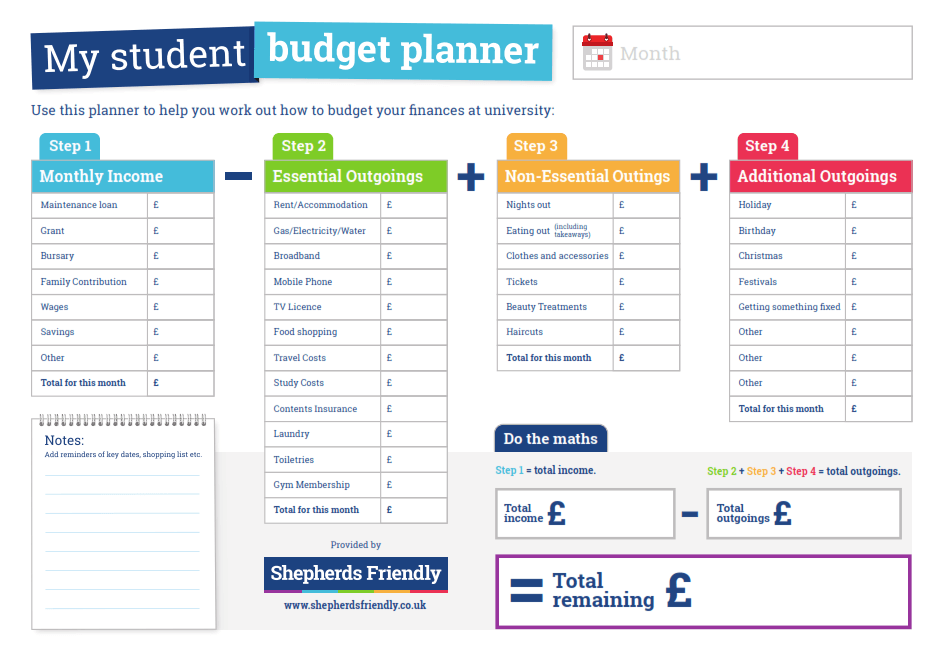

Student Budget Planner Infographic

When students move away from home for the first time, it can take time to adjust to a new way of living and having to fend for yourself. It can be a little daunting to some. Therefore it is important that students fully prepare for this big change before starting their first term. A good start is creating a student budget.

Shepherds Friendly have created a student budget planner to help students manage their money at college or university. This planner is the ideal month-by-month student budgeting guide to stick on a notice board as a reminder of what students can afford to spend each month. This university budgeting resource will help students to budget their income each month so that they can ensure they can afford their lifestyles.

Before you start – Consider the following:

Your money needs to last all term.

- Don’t go on a spending spree as soon as it enters your account.

- Can you accumulate some savings before you go?

Set up a student bank account.

- Do your research on student bank accounts for the best deal.

- Look out for an account which has an interest free overdraft.

- Don’t choose a student account because of the freebies on offer.

Don’t forget to sort out your student finance so you know how much you will be receiving from your student loan provider per installment (if needed).

Teach yourself the difference between wants and needs.

- Do you really need that new pair of shoes for a night out?

How to use the student budget planner:

Tip: It is best to fill out the form in pencil to begin with in case you have to change step 3 and/or step 4

Step 1: Start by working out your monthly income. Add each of your incomes together to make a total income amount and then add it in the total income box in the ‘do the maths’ section.

Tip: With regards to your student maintenance loan divide the amount you receive in instalment 1 by how many weeks are in the term and then check how many weeks are in that month to spread it out fairly.

Step 2: Calculate the cost of your bills that are necessities. These may include rent, your phone bill, food shopping etc. Add them together to make a total.

Step 3: Work out things you would like to do this month but you could do without (having this as a separate section will help you cut down on outgoings if you notice you’ve gone over this month). Calculate the total.

Step 4: Is there someone’s Birthday this month? Do you want to go on holiday, or is there a particular event that you really want to go to? Add it here in the additional outgoings section and see if it’s affordable this month.

Step 5: Add step 2, 3, and 4 together to calculate your total outgoings and add it to the appropriate box in the ‘do the maths’ section’.

Step 6: Subtract your total outgoings from your total income to calculate your total remaining amount.

Not got enough income for your outgoings?

- Increase your income – Have you considered a part time job during your days off university? Could your parents contribute?

- Reduce your expenditure – Is there anything you could take out of step 3 or 4? Remember the difference between wants and needs.

- Speak to an adviser – Most universities have a student money adviser who can help you manage your income and suggest solutions.

- Consider borrowing options –Only consider this option if no other options are available as you could be creating a larger debt for yourself. Remember the less you borrow the better your financial situation should be when you finish university.

What can I do with my ‘total remaining’ budget?

If you have money left over in a month, you need to think about the best way to invest it to get the most for your money.

- Do your budget for the following month. Will you need it then? Do you have some big event coming up that you could do with saving for?

- Add it into a savings plan. It could make your money go further and may stop you being tempted from spending it on something you don’t really need.

It is important you think about the most sensible options on what to do with your total remaining.

You can adjust your cookie preferences here.